We had a good rally from 15800 -17000 in just few sessions . Would you call this Bull Market , Bear Market or Technical Bounce . Who cares what ever it may be as invetment is just to bring maximum return .

Our last free recomentation here also paid :

Hindalco : 131- 161

Tatamotor : 740 -790

Bank Nifty : Near 10k.

What next what to do with this portfolio that you are holding ?

If you are short term Swing trader our advise would be booking short term gains and sit in cash for next opportunity

If you are medium term investor you can hold possition with sl of 3%

Long term investors hold on possition .

Fno traders who have leverage possition can exit entire possition @ 5220 or keep sl of 5076 and trail profit

Happy Investing !!!!!

Regards

NIFTYTRENDS TEAM

NIFTY TRENDS

Friday, September 9, 2011

Friday, August 19, 2011

Time for investment Buys!!!!!!

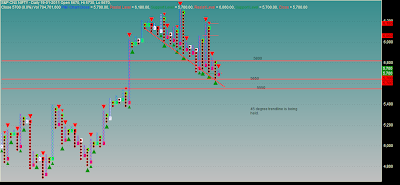

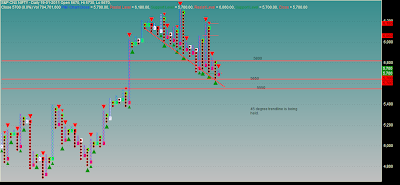

NIFTY never crossed high of channel shown in below chart and continue to move down. Market was in tight range and holding same since long time and given breakdown on downside .

Nifty current view : Time to start investment .This will be golden investment of your life time rembember the same as many midcaps and heavy weight are lowest point of weekly support.

Some of our picks : Investment can be done in Bank nifty near 9340 ,Tatamotor near 732-740, Hindalco near 131. Icici bank near 790-810 .

Downside risk is lower here according to us as there is derivative expiry in 5 days and History reveals a good bounce from weekly support .

Regards

Nifty TrendsTeam .

Nifty current view : Time to start investment .This will be golden investment of your life time rembember the same as many midcaps and heavy weight are lowest point of weekly support.

Some of our picks : Investment can be done in Bank nifty near 9340 ,Tatamotor near 732-740, Hindalco near 131. Icici bank near 790-810 .

Downside risk is lower here according to us as there is derivative expiry in 5 days and History reveals a good bounce from weekly support .

Regards

Nifty TrendsTeam .

Thursday, May 19, 2011

Friday, May 6, 2011

New Low or New High !!!

Dear Readers ,

We have showed in our last posting that some big movement was due and that happened . Nifty was not able to cross 5930 and broke support of 5760 which made panic selling .But question is that will this fall sustain , its unusual question as generally people say will this rise will be sustained ?

According to our view we don't see market falling below 5440 on closing basis. Just now this was one way cut in rate concern sector but I feel its too much .May as we all know is bad month for Bulls as we see history of market but this year we feel history will be not repeated . Our reports on index wise analysis will be available on weekend .

Some of value picks according to us : Vijya bank with sl 69 target 86+,

Bank nifty with sl 10554( closing basis) target 11400, 11630,

Bhel : with sl 1970 target 2390 .

Patel eng ,Sadbhav eng ,Tata steel ,Timken india, Goldyne technology.

Regards

Niftytrends Team

We have showed in our last posting that some big movement was due and that happened . Nifty was not able to cross 5930 and broke support of 5760 which made panic selling .But question is that will this fall sustain , its unusual question as generally people say will this rise will be sustained ?

According to our view we don't see market falling below 5440 on closing basis. Just now this was one way cut in rate concern sector but I feel its too much .May as we all know is bad month for Bulls as we see history of market but this year we feel history will be not repeated . Our reports on index wise analysis will be available on weekend .

Some of value picks according to us : Vijya bank with sl 69 target 86+,

Bank nifty with sl 10554( closing basis) target 11400, 11630,

Bhel : with sl 1970 target 2390 .

Patel eng ,Sadbhav eng ,Tata steel ,Timken india, Goldyne technology.

Regards

Niftytrends Team

Tuesday, April 26, 2011

Nifty Short term view

Thursday, April 14, 2011

Nifty 15/4/11

Wednesday, March 23, 2011

Sunday, March 20, 2011

Nifty update 21 Mar 2011

Sunday, March 13, 2011

Tata Steel EOD chart 14/3/11

Monday, March 7, 2011

Bank Nifty 8th Mar

Monday, February 28, 2011

Nifty outlook for 1st March

Thursday, February 24, 2011

Nifty update 25 feb

A very volatile month with wild moves in nifty. Today Nifty fell more than expected. There was a gap down in nifty with huge vols. This is not very good for market. The next 2 trading days should be avoided as Rail budget and Union Budget. Nifty is also near Trendline supports. All bounces will be a fresh short as of now.

Sunday, February 20, 2011

Bank Nifty real Wealth Builder

Friday, February 18, 2011

outlook Feb 18

Wednesday, February 16, 2011

outlook for 17th feb

Tuesday, February 15, 2011

outlook for 15th Feb

Nifty has moved up smarhttp://www.blogger.com/img/blank.giftly from friday. Bank nifty has given a 10 percent upmove. Today Index was in a narrow range. It is facing resistance around 5515-5520 levels above which we will see more upmove. Keep a trailing stop loss if you are long

McLeod Russel

This is a weekly chart of McLeod Russel. We have seen a good consolidation in a triangle. A breakout will give a target of 234 and then 265 levels on upside. The breakout will also be a breakout of RSI from triangle. A strict stop loss of around 200 can be maintained.

McLeod Russel

This is a weekly chart of McLeod Russel. We have seen a good consolidation in a triangle. A breakout will give a target of 234 and then 265 levels on upside. The breakout will also be a breakout of RSI from triangle. A strict stop loss of around 200 can be maintained.

Sunday, February 13, 2011

Nifty 14th Fb

Nifty gave a good recovery on friday. The volumes also were good during the upmove. The levels to watch is 5370-80 and then 5450. There are many resistances after 5450 levels. The oscillators are in oversold regions. This might be a short term pullback. Watch for any weakness. As of now, exit on rallies on the upside.

Friday, February 11, 2011

Nifty update 11 Feb

Nifty is trying to hold on to the supports mentioned earlier. Now we may see Nifty volatility coming down and markets may try to move up a little. Risk traders can write 5100 PE for expiry. Some stocks which look good are Essar Oil, Cairn India.

Wednesday, February 9, 2011

Feb 9th

People living on hope that Nifty will take one support or the other. But there is relentless selling pressure. Stop losses also get hit in volatile markets. Nifty broke some important supports. All rises should be an opportunity to exit.

One good investment pick is Financial Technologies.

This is the weekly chart where we can see a falling wedge pattern. Good volumes also being observed in last two and a half weeks. Is it accumulation?

Target on upside is around 850-900.

One good investment pick is Financial Technologies.

This is the weekly chart where we can see a falling wedge pattern. Good volumes also being observed in last two and a half weeks. Is it accumulation?

Target on upside is around 850-900.

Tuesday, February 8, 2011

Updates for Feb 8th

Nifty today broke some crucial supports. We will have to watch tomorrow the movement. On the downside 5250 to 5150 is the support. There is relentless selling and all levels are being sliced through. Wait for some stability to enter any fresh positions in Nifty.

TITAN IND

This is the daily chart of Titan. It fell today with good volumes and closing below good supports. Short trade posible in it keeping 3300 as SL for a 100-150 rs downside. As market is too volatile, SL is a must.

TITAN IND

This is the daily chart of Titan. It fell today with good volumes and closing below good supports. Short trade posible in it keeping 3300 as SL for a 100-150 rs downside. As market is too volatile, SL is a must.

Monday, February 7, 2011

nifty update

Hi,

Nifty as we have got used to it this year was volatile. It is holding on the the cluster region. So our weekly outlook remains the same.

SBI is a buy above 1730 for a Rs 100 upside.(spot levels)

Nifty as we have got used to it this year was volatile. It is holding on the the cluster region. So our weekly outlook remains the same.

SBI is a buy above 1730 for a Rs 100 upside.(spot levels)

Sunday, February 6, 2011

Outlook for the week Feb 6

Nifty in daily chart is at crucial support regions. The region of 5350 if broken can take us down to 5200 levels. The oscillators like RSI and stochastics are in oversold regions. We might expect a slight pullback but this should be used as exits. As of now 5600 is still the resistance area.

The weekly chart shows Nifty in a downward channel but at crucial supports. If this region is broken decisively then we are headed for 5150-5200 levels.

Tuesday, February 1, 2011

Nifty 22 Feb

Monday, January 31, 2011

Nifty hourly for 1 Feb 2011

Nifty took support near the lower end of the downward channel. The spot has formed a higher bottom which is a good sign. The oscillators like RSI and Stochastics have started moving up. Stochastic is moving up from oversold regions. On the upside Nifty can face resistance around 5600 to 5650 levels.

Sunday, January 30, 2011

Nifty outlook for 31 Jan 2011

This is the hourly chart of Nifty futures. The last hour on friday produced a bullish engulfing candle. The stochastic is oversold and trying to move up. So, a temporary bounce to 5600-5640 can be expected which happens to be a fibonacci level and also has a trendline. Trades should be done with stop losses as markets have been very volatile.

Nifty Trend ffrom 1995

As the blog suggests, let us analyse the trends in Index(Nifty) from 1995. We are using a trend cycle oscillator (Schauff Oscillator). More about it can be found here(click here)

The vertical lines show the change in trend as given by this oscillator. Only once it has failed (to predict a big change). But it has given very good signals of a trend change. The bad news is that it has given a trend change this month. So we have to see how low the market goes.

Thursday, January 27, 2011

Nifty 27 Jan 2011- Where is it heading?

Today we saw Nifty coming below its 200 DMA and closing near the days lows. Where is it headed. The oscillators indicate oversold but in a trending market they generally dont work. The next support(wish) is 5550 and then we head down to 5400 area. This is now a budget month. We should just follow the trend and trade accordingly. Budget stocks like railway and fertilizers may see some action in the coming days.

Accumulate good stocks like ITC, HUL, Hindalco at dips for a medium to long term investment.

Wednesday, January 26, 2011

Nifty outlook for 27 Jan

RBI rate hike was on expected lines. But Nifty could not sustain above 5775 for long and fell below 5700 levels. As it is expiry day for Jan series, better to keep light positions and if long in nifty maintain the stop loss of supports given earlier(week outlook).

Larsen and Toubro recommended gave 2 percent return in one trading session. It hit our first target of 1700.

It is also our investment pick.

Larsen and Toubro recommended gave 2 percent return in one trading session. It hit our first target of 1700.

It is also our investment pick.

Chambal Fert- A budget stock

Monday, January 24, 2011

Outlook for 25 Jan 2011

This is the hourly Nifty chart.The important level is 5760 which has not been broken on the upside. Above that we can see a good move in Nifty to 5850. Tomorrow being RBI credit Policy, trades in Nifty futures should be done with stop loss.

We had recommended Larsen and Toubro as a good buy.

Let us see the hourly chart of Larsen and Toubro futures.

There has been good accumulation in this scrip and today had higher than average volumes. A break above 1680 will give a target of 1700 and 1800.

Sunday, January 23, 2011

NIfty outlook for the week

The past week has been a week of consolitation for the markets. We saw Nifty moving in a range. The support is around 5620-5640 and resistance is at 5775 and 5850 levels. Maximum calls have been written around 6000 to 6200 levels and puts below 5600. This is an expiry week and also a shortened week. RBI policy is on the 25th which has to be watched out. Last week we saw many of the smaller banks and private banks seeing short covering and hence we saw a rise in Bank Nifty.

We feel that FMCG and metals are still looking strong and can be bought at dips. HUL and Hindalco are good stocks to buy. Hindalco has a strong support around 220 levels. HUL can be accumulated at all dips as it is in a weekly ascending channel.

Friday, January 21, 2011

Jan 21 intraday levels

Yesterday we say NF rallying up but it found resistance around 5740-50 area. This also happened to be the 200 EMA in 15 min Time frame. This area is showing resistance in daily time frame too. Important level on the upside is this area. Downside support exists around 5620 and 5640. All are futures levels.

Happy Trading!!

Happy Trading!!

Thursday, January 20, 2011

Larsen and Toubro Analysis

Let us first look at the daily chart. Larsen has fallen fast from the highs. We see that it is near the support region. RSI is in oversold region. We need to get some confirmation from the indicators of a pullback. The first target is around 1700and 1850 levels.

Now let us look at the weekly charts.

We see that the price has touched the 100 EMA which also happens to be a trendline and a fibonacci level. The other indicators like RSI are in oversold territory. A pullback can be expected(one day of the week is still left). The target is around 1840.

Wednesday, January 19, 2011

India economically Boom or Turning Doom with Inflation

Onions !!! Petrol !!!! Beer!!!! what you would like to have this New year all at same cost @ Rs 60 in Delhi . Is this price rationalistion going according to Govt ?

Nifty @ 6180 not crossed and inflation fig came since then one fever infected all investors mind where we are going . This fever was at its peak from 7th jan to 12 th jan where fall seem have no stopping .Adding fuel to fire TV analyst litterly robbed all retail invetors creating panic that we are going for 5400 ,4800 Bla Bla !!!!

Lets analyse Fii figures

Category Date Buy Value Sell Value Net Value Nifty bees close

FII 19-Jan-2011 3167.71 3438.09 -270.38

FII 18-Jan-2011 2699.71 2627.17 72.54 581.39

FII 17-Jan-2011 2569.50 2742.50 -173.00 573.52

FII 14-Jan-2011 2020.72 2769.32 -748.60 575.51

FII 13-Jan-2011 3370.21 3619.98 -249.77 584.28

FII 12-Jan-2011 3366.80 3738.30 -371.50 594.89

FII 11-Jan-2011 2726.62 3889.19 -1162.57 578.69

FII 10-Jan-2011 2633.69 3772.47 -1138.78 585.01

FII 07-Jan-2011 2397.19 3437.93 -1040.74 598.97

FII 06-Jan-2011 3274.86 3660.49 -385.63 607.46

FII 05-Jan-2011 3245.55 3485.85 -240.30 614.67

FII 04-Jan-2011 3381.89 2664.13 717.76 617.75

FII 03-Jan-2011 1516.59 1175.62 340.97 621.66

Big fund houses and Big Market gurus started calling investors back to U.S.

US, Europe Better Bets as Inflation Hits: Marc Faber

Source :http://www.cnbc.com/id/41151067

Goldman Sachs warns against investing in India, China

Source : http://economictimes.indiatimes.com/news/economy/finance/goldman-sachs-warns-against-investing-in-india-china/articleshow/7313455.cms

Do you think that we are in so Bad shape that money will outflow from India ? Comments Welcomed!!!

We technically think that we have discounted many Bad news and consolidating for next move .

We are showing point and fig charts this is same type of analysis that we have done @3700 again @ 5300 .

Charts shows that we are holding and consolidating .

Bulls need to move up and break 5800 . Two close above 5800 we make rocket move till 6100. with good support near 5650 -5550 zone . Any new Bear in this range will be butched badly .

Regards

Niftytrends Team

Nifty @ 6180 not crossed and inflation fig came since then one fever infected all investors mind where we are going . This fever was at its peak from 7th jan to 12 th jan where fall seem have no stopping .Adding fuel to fire TV analyst litterly robbed all retail invetors creating panic that we are going for 5400 ,4800 Bla Bla !!!!

Lets analyse Fii figures

Category Date Buy Value Sell Value Net Value Nifty bees close

FII 19-Jan-2011 3167.71 3438.09 -270.38

FII 18-Jan-2011 2699.71 2627.17 72.54 581.39

FII 17-Jan-2011 2569.50 2742.50 -173.00 573.52

FII 14-Jan-2011 2020.72 2769.32 -748.60 575.51

FII 13-Jan-2011 3370.21 3619.98 -249.77 584.28

FII 12-Jan-2011 3366.80 3738.30 -371.50 594.89

FII 11-Jan-2011 2726.62 3889.19 -1162.57 578.69

FII 10-Jan-2011 2633.69 3772.47 -1138.78 585.01

FII 07-Jan-2011 2397.19 3437.93 -1040.74 598.97

FII 06-Jan-2011 3274.86 3660.49 -385.63 607.46

FII 05-Jan-2011 3245.55 3485.85 -240.30 614.67

FII 04-Jan-2011 3381.89 2664.13 717.76 617.75

FII 03-Jan-2011 1516.59 1175.62 340.97 621.66

Big fund houses and Big Market gurus started calling investors back to U.S.

US, Europe Better Bets as Inflation Hits: Marc Faber

Source :http://www.cnbc.com/id/41151067

Goldman Sachs warns against investing in India, China

Source : http://economictimes.indiatimes.com/news/economy/finance/goldman-sachs-warns-against-investing-in-india-china/articleshow/7313455.cms

Do you think that we are in so Bad shape that money will outflow from India ? Comments Welcomed!!!

We technically think that we have discounted many Bad news and consolidating for next move .

We are showing point and fig charts this is same type of analysis that we have done @3700 again @ 5300 .

Charts shows that we are holding and consolidating .

Bulls need to move up and break 5800 . Two close above 5800 we make rocket move till 6100. with good support near 5650 -5550 zone . Any new Bear in this range will be butched badly .

Regards

Niftytrends Team

Friday, January 14, 2011

Nifty at make or break!

This is the daily Nifty chart. Nifty has held 5700 for now and bounced from the Trendline. Nifty is also very near to the 200 EMA. Whether this will be held is a big question. FII selling has come down in the last 2 days. Will there be a technical bounce to 5900 and then a downward journey again?? CCI has not yet confirmed a sell. Traders should trade with tight stop losses and wait for a major move on either side.

Thursday, January 6, 2011

CNX IT Daily chart

Subscribe to:

Comments (Atom)